5 min read! DSAIRe Awareness Series

The CIOs, CFOs and Heads of banks and financial institutions sharing their stories with data science – article and summary down under 👇

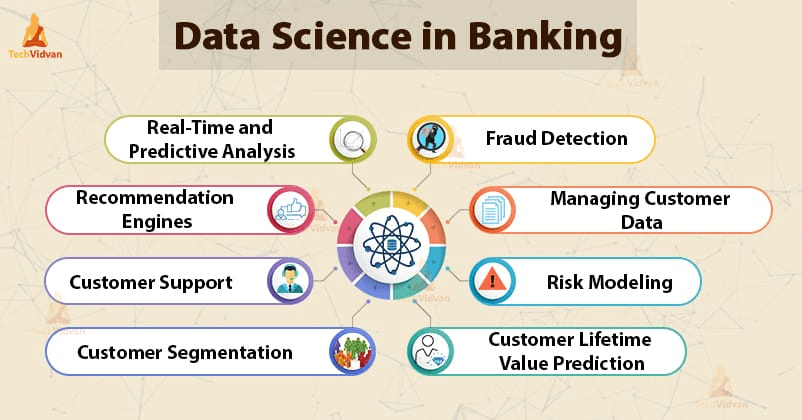

Banks and financial institutions use data science to remain competitive in today’s ever-changing marketplace. By leveraging the power of data, they make decisions that improve their products and services, enhance customer experience, and reduce costs. Data science applications help banks and institutions in many ways, such as:

- Automated fraud detection –

Banks and financial institutions use data science to detect fraudulent activity by looking for patterns and anomalies in customer behavior.

- Customer segmentation –

Data science helps banks and financial institutions to identify key customer segments and create personalized marketing strategies based on customer profiles.

- Next best offers –

Banks use data science to find opportunities for cross-selling and up-selling, by identifying customer needs and offering relevant products and services.

- Churn prevention –

Data science helps banks and financial institutions to identify customers at risk of leaving, so that banks and financial institutions can implement strategies to retain them.

- Lifetime value prediction –

Banks and financial institutions use data science to predict customer lifetime value, which can be used to design more effective loyalty programs.

- Risk management –

Banks and financial institutions use data science to identify, measure and manage financial risks more effectively.

- Algorithmic trading –

Banks and financial institutions use data science to develop algorithms that can automatically execute trades and manage portfolios in the stock market.

- Portfolio optimization –

Data science helps banks and financial institutions to optimize their portfolios and diversify their investments in order to reduce risk and maximize returns.

- Predicting stock prices –

Financial institutions use data science to analyze market trends and predict stock prices, helping them to make better investment decisions.

- Detecting financial crimes –

Data science is being used to detect patterns of financial fraud and money laundering by examining suspicious activities within a network of transactions.

- Loan default prediction –

Banks use data science to identify potential loan defaults and adjust the credit risk accordingly.

- Identifying financial risks –

Data science helps banks and financial institutions to analyze the data related to interest rates, inflation, and market trends in order to identify and manage financial risks.

- Stress testing –

Banks and financial institutions use data science to simulate different economic scenarios in order to assess the impact on their portfolios and investments.

- Evaluating the impact of economic policy

Data science is being used to evaluate the impact of economic policies on financial markets, helping financial institutions make more informed decisions.

- Big data analysis –

Data science helps banks and financial institutions analyze large amounts of structured and unstructured data in order to extract valuable insights and optimize operations.

These are the major reasons why banks, financial institutions and even CFOs of organizations are keen to implement Data science in financial services and arenas.

Here are a few Use Cases Summary in the financial sector from the following article and beyond

Bajaj Finance / Finserve – NBFC: Magic of data Science

- Created Enterprise data warehouse that collects and stores data from various platforms

- critical risk portfolio analysis – loans are given to the right customers

- Tableau does in 8 to 10 hours, that used to take 3-4 days.

- 2.5 million transactions a year 2022;

- The stock value in 10yrs: 1 lakh invested, today is around 5 Cr at 80% CAGR

Federal Bank –

- Locating ATMs (where to open new, which one to shutdown, saving on interbank transaction costs),

- SM sentimental analysis,

- Effectiveness of marketing campaigns…

IndusInd Bank – Dashboards on

- Customer analytics,

- Fraud analytics,

- Risk analytics

churning terrabytes of data, at everyone’s fingertips without IT / data teams

DBS Bank –

- Right products to right customers through analytics, profiling customers

- Customize apps for every customer, for his or her needs.

- Answer questions even before they are asked.

AXIS BANK

- Customer segmentation

- Need based Analysis

- Hyper-personalization of apps

- Best products for the customer

- Gauge the possibility of customer default on loan or card payments

- Video based recruitment process for various roles – expressions, tone of voice analytics

The CFO and Finance Department have the finger on the pulse to the financial health of any company, and can create similar magic as any financial institution.

Embrace data science with a 2-day deep dive in understanding how you can go about.

Register for Data Science AI Retreat in Nairobi (March 1-2) and Dar Es Salaam (March 8-9)

https://www.careerlauncher.com/machine-learning/csuite-africa/dsretreat